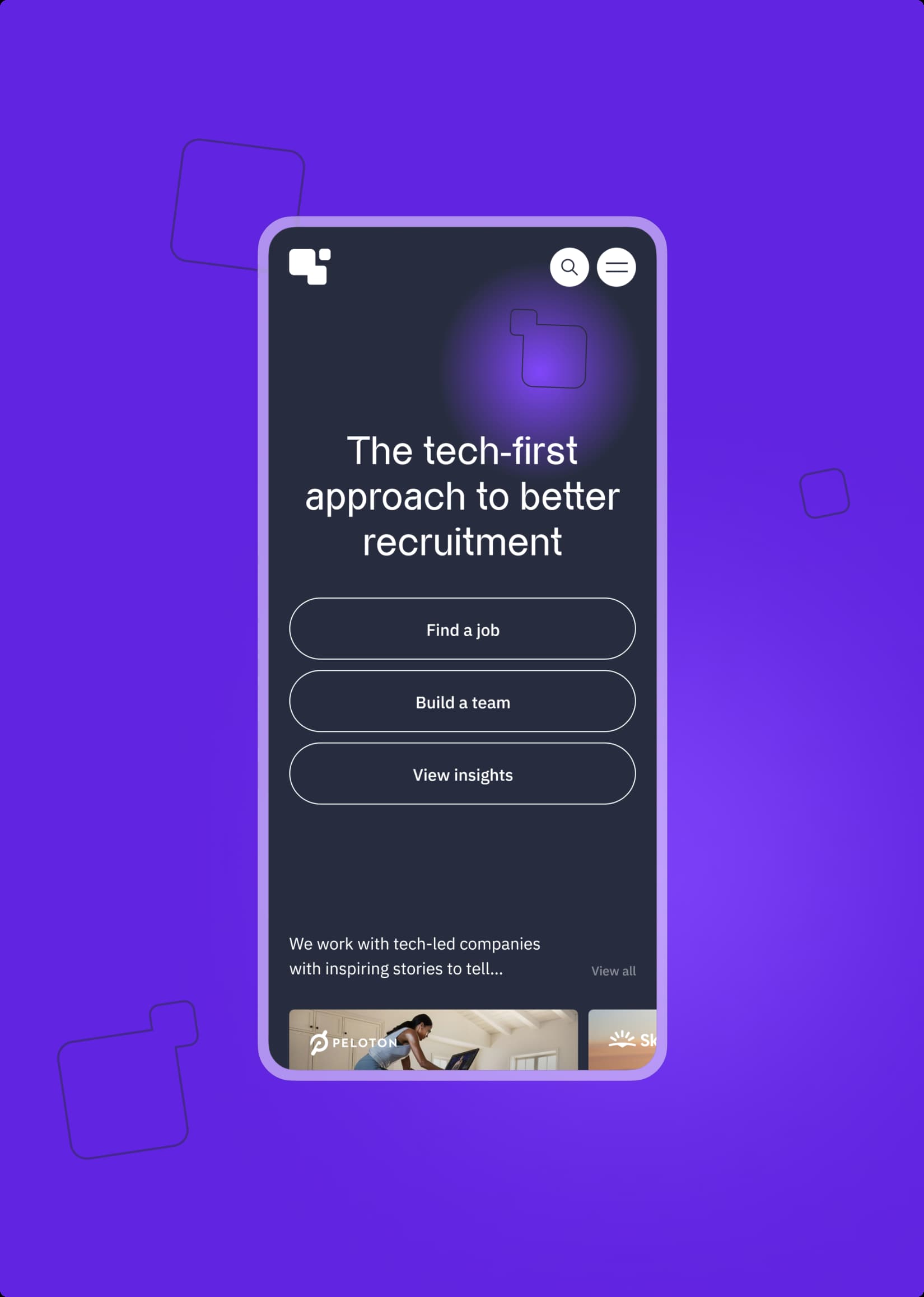

13 Best Recruitment Website Designs of 2025

14 Beautiful Brand Examples from Small to Medium Businesses

Brand Guidelines: What Belongs in Your Style Guide?

17 Best Architect Websites of 2025

Leading Digital Transformation Consultancies UK 2025

Best Law Firm Web Design of 2025 – 14 of the Best Websites

Top Website Design Companies in the UK 2025